The Impact of Election Results on the Stock Market

Hi everyone welcome to today’s blog on today’s post I’m going to discuss five critical points that is impacting the market right now what does the fractured mandate mean why is it that stocks like Hindustan Unilever have become a rocket today and what should you do with SBI type of stocks adani type of stock so I’m going to give you very quick commentary in five-six simple points this hopefully will help you understand whether you should stay in the market get out of it I will talk a little bit about Nifty levels also so this will be a mix of politics economics Finance Stock Investing so read it from that just very quick note people who are new to my blog my name is khushal oza I’ve been working in the investment space for the last 2 years working in Consulting I now run my hedge fund so these are like really hot times in that sense that I have to make like a lot of decisions these days all right so on that note I’ll be quick to the point so okay so five-six points.

We are going to discuss the first critical point regarding the fractured mandate so on Monday the market gave a run-up of roughly 4% the reason was that everyone expected the BJP to win and come out with

full-fledged majority 400 PAR etc. it did not happen now it’s not even going to be a BJP government it’s going to be an NDA government and this changes the Dynamics quite aggressively this is a fractured mandate so to say so if you have to talk about three really important economics narrative here

Best Long-Term Stocks to Buy in India for 2024

:-First point

The first would be that a lot of data is going to come out right just for context there have been 17 vital data points or data sets that have not been released in the last few years one of them being sensors of India this is a very important document that is supposed to be released but data now that data will also come most likely because there is a stronger opposition bunch of other different things right so this is one and bunch of other data points are going to keep coming up every now and then and this is going to impact the markets so this is a critical point that you need to understand.

:-Second point

The second critical point is that the media narrative had been overly bullish over a lot of things I will again not harp on that point the point is that media is likely to get a little bit fairer I’m not saying it will be extremely fair but at least side of the equation you will hear so it will not be sentiment driven things much of it might be fundamental driven things this is the second key economics change that will happen in the market.

The third key change is that it will be hard to bulldoze decisions good ones and bad ones, bad ones, for example, demonetization was a really bad step according to my analysis of several economists even official organizations have categorically said that demonetization was a failure in fact the presidence was so bad in the sense that you know a country demonetizing its own currency it just sets a really bad precedence International organizations or International HNIs and FIS they stop trusting how can you trust their debt how can you trust their money so to say so just created Widespread Panic people just speak about like unorganized sector stuff and impact of demo monetization on that I’m talking about the market impact so again not going to Half too much on that so these type of decisions will be very very hard to make.

Now this has pros and cons the pros for this are that seeing consensus-based decision-making it kind of dilutes the business environment a little bit but on the flip side it increases data transparency increases real Trust in whatever is coming out it opens up things for debate which are always good from a mid to long-term perspective so this is point one point two is that how is Market likely to behave due to this very important change that has happened so this brings me to point two and for this, a good chart to see here would be

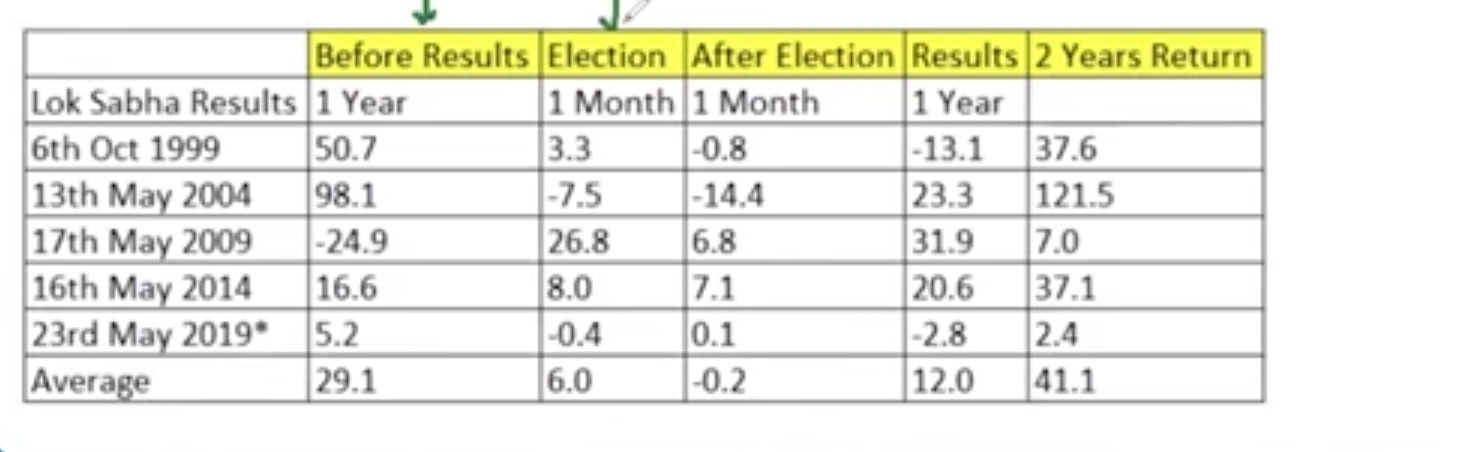

this one and this speaks about the election rally okay so before results during election after election two years after returns see guys I run an investment community so investment Community I am not catering to Traders I am catering to investors so if you are someone in job who wants to invest money and you know have like a reasonable amount of time in the market then this commentary is relevant for you so at least as an investor we always take one year to two year timea at least so at least whatever if you’re putting like today you should have the vision I’m not going to withdraw this vision with which you should operate yes opportunity profit booking and all that then you do it that’s not an issue but you should work with the assumption that.

hey, whatever money I’m going to put in today I’m not going to take it out in the next two or three years right so then the news is very positive for example right 2004, 9, 14, 19, and look at this 2019 tab it has given return 2.4 well this was what this was a crash Market okay similarly in 2009 2020 right I mean from this point so that was the issue right similar 2008 was a major Panic year so this again this data point has been skewed due to that but otherwise typically 12 to 15% you should be making returns okay so this is part A absolute short term right and start expecting returns from tomorrow one month from now or two months from now please keep in mind that if you’re buying the dip in the stock market you have to have like at least a career Vision so what did I do uh when the election results were announced they were not favorable Market corrected by 6%.

:-Third point

I’m telling you okay third key point that we need to understand is short-term Panic versus long-term opportunities but what I will say is that see short-term Panic just for example right now whatever is happening this is short-term Panic now I cannot guarantee that this Panic will exist only for one month or you know 3 months or four months I don’t know right I mean maybe it will reverse from next week who knows right and people will keep on giving their commentary they know they don’t know all you can do is buy the panic.

:- Fourth point

And continue to buy the Panic which brings me to the fourth point and this is a very critical point that has to do with your cash flow management I had been literally a financed guy who was coming out in full swing saying you know what guys please manage your cash flow now how am I managing my cashflow I’ll give you two examples so one is that I’ve picked up a lot of real estates I have been an advocate of buying good real estate last since the time I had started buying real estate communicating to all of you real estate prices have shot up like anything anywhere okay whenever ever there is panic in the market okay so right now there is panic in the market do I have the money to buy it yes because I managed my cash flow why this was reason number one reason.

Number two is again very simple I had been speaking aggressively about something called an opportunity fund key that keeps at least 20% of your money on the sidelines 20% money whatever you do sip with keep 2,000 aside when do you need to invest now okay so this is the point right so that is what I have been doing and I will continue to do again I am not married to real estate equities bonds taxation structure will go right I mean it’s not as if Equity pay if they put like direct tax code and for long-term capital gains they make like 25 30% now do you think that Equity investing is still efficient no it is not then you have to be highly Diversified okay so this is the bottom line it’s not as if you know because Equity had given the very good run-up in the last 20 years it will continue to do no you have to be a sensible investor analyze your opportunities and this is what I’m trying to teach you.

:-Fifth point

okay now comes the fifth point which has to do with defense stocks about building a balanced portfolio, for example, I’m an aggressive investor 85% of my portfolio went down why because that’s the aggressive part right if the market is going down this will fall down but if I have to fall less than the market so to say so I will balance it out by buying defensive stocks like Hindustan Unilever and exactly Hindustan Unilever type of stocks are kind of making me safe right so that is called as balancing your portfolio now this is something again stuff understand more but very quickly HUL type of stocks serve some purpose should you buy it now okay

because there is more panic in the market market now okay it really depends on the panic situation in the market so therefore as investors one of the key lessons that we need to learn is that you also need to balance out by buying some defensive stocks like HUL okay and do not make fun of these stocks.

these stocks serve a very specific purpose to your portfolio final point I will talk about two-three types of stocks: bad stocks, bad stocks mean there a no Clarity stocks if these stocks fall you will not know what to do with them adani stock

these types of stocks by simple question let’s see if this stock Falls by another 10% what is your strategy now you’re sitting on a 30% loss Risky stocks can always backfire because you would not know when to cut your positions and get out of so this can become a very very problematic scenario for new investors there are so many stocks so just pick one that you have confidence in also you are going to hold it okay then what about other things, for example, in the last 5 days it has fallen by 7% fundamentals check State Bank of India the performance has been at all-time best so to say so all that yeah SBI is a very politically sensitive type of stock it is not a very politically sensitive stock PSU Focus government it’s not as if you know what that it was only Modi’s focus on PSU Banks all that stuff so that will not be the case what are good stocks to buy again I keep on saying you know HDFC for example because you know I keep on referring it because best ever results right by far look at the growth rate right if you look at the sales growth rate profit growth rate is there is no any problem with the stock and is it still available at a discount yes all right I mean whenever the runup happens in the private bank space you’ll be fine now.

:-Six point

What is it that I’m making the final point right

I’m buying nifty50 right now why because I have already built individual positions on a lot of stuff right now there are panicked uncertain times so nifty50 is the safest uncertain times so nifty50 is the safest point.