Hello guys this is Khushal Oza. Welcome to my blog. So let me start today’s article by sharing a small story with you regarding Mr. Warren Buffett in 2007, Mr. Warren Buffett was asked that, hey, Mr.Buffett, how much money or how much taxes do your employees generally pay in a financial year? So he said, my employees pay 33% tax. And he said that how much money do you pay in one financial year? He said that I pay approximately 18% tax. Now you might be wondering why someone who is working for Mr.Warren Buffett is paying almost 2X the taxes compared to what Mr.Warren Buffett pays. Why is that? Now, here comes the very important concept for you to understand that

“What is the difference between income and wealth”?

Now, this is one of the key central arguments of Thomas Piketty, who is an economist, author,

and he speaks a lot as to why wealth needs to be taxed more compared to income. This is precisely what we are going to understand on today’s article. I am going to share with you five simple examples that would almost convince you to start a business super important because I keep on saying on this blog that you must create, like multiple income streams, you must start your own digital businesses and a bunch of different things. But today you will categorically understand through these five examples why this is such an important concept.

Power of owning a business

Let me start by giving you the first example as to what is the difference in terms of when I buy things from Amazon with a list when the majority of the other people are buying it.

And please, I’m not doing this from a show-off perspective.

I’m just helping you visualize the power of owning and running businesses. Okay, so let me take you to my Amazon portal and you can go and check this out yourself.

Right?

So let me try to buy a 2020 Apple MacBook Air 13-inch M1 chip. This that okay? So you see this price, right?

INR 87,900. This is inclusive of GST. This is the price that a normal retail consumer will pay.

And what price am I being asked to pay? I am being asked to pay INR 74,491.53 And it categorically saves excluding GST. So basically it means that I’m going to get a GST rebate on it. Right? This is the first example. This is not some discount that is running.

I will get this for almost all the consumer durable products. Okay, so let me try to buy an air conditioner, right? An air conditioner.

Okay, so let me go to Panasonic a normal retail investor would be spending approximately INR 39,990, including GST. I am going to spend INR 30,460 exclusive GST. All I have to do is add two cards and normal stuff that we do on Amazon anyway. So you can see huge legal tax-saving opportunities in terms of any product. And this does not just simply work for expensive products. This also works on inexpensive products. Right.

So, let me say I’m trying to buy a MacBook cover.

Right. Let me try to buy MacBook cover and let me see if this works again. I’m going to the first link now 399 inclusive of GST, and I will get it at 338 exclusive of GST.So you can that if you own a business that is GST registered, you will get a lot of tax rebates in terms of GST credit inputs. Now, I’m not a CA. I’m keeping this article super simple. If there are counterarguments, I’m very happy to hear them, but I’m simply trying to tell you that if you own a business, you can save a lot of money in taxes. Legally, that is the important one.

And very quick Disclaimer.

These are not product buying recommendations, because every time I write an article, you guys say that you are advising us to buy this stock, that stock.No, I’m just showing you samples here.

I’m not buying all these products.

Now, if you compute all the items that you would be buying in a year on Amazon, and if you take approximately a 10%

savings rate, it will come out to be a lot of money that you can save in a year. I’m not doing that math because it would depend on how much you are spending on Amazon. What exact GST rebate? You are getting a bunch of different things, but I hope you get the picture right.

Second example

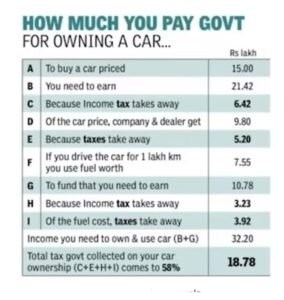

Okay. Now let’s move on to the second point. Now, here is a small clip about buying a car. Right. This is an article that came out in the Economic Times last year, and it was a very interesting article. Let us quickly go through it if you are trying to purchase a car, which is worth 15 lakhs.

So how will you go and buy it? You will essentially transfer that money

from your bank account, or you will pay a check or a demand draft

to that particular car dealer, and that car dealer will give you the car. Right.

So you go present them a cheque of 15 lakhs. That 15 lakh is a saving for you, not your income.

For example, if your income is let’s say 100,000 or one lakh rupees, then the tax would be let’s assume 20%.

Right. So you’ll be paying 20,000 in income tax and rest will be 80,000 in savings.

Right. So this money probably becomes a part of your savings super simplifying the example. Right. So this is the saving.

Right. So when you buy a 15 lakh car with your savings how much money you are actually spending? So that was the essence of that article. So let me quickly take you through that. So in order to buy a 15 lakh car, you need to earn 21.42 Lakh. Assuming different tax laps, then you also need to incur petrol expenses or diesel expenses repair what not? So a bunch of different buying plus operating expenses that go into buying and operating a car. Now, if you would have owned a business, there are a bunch of savings that you can foster.

For example, number one, you can check out depreciation. Now again, I am not a tax expert. I’m a money-making expert. I just understand basic taxation. But the point is that if you’re owning a business the number one, you can definitely depreciate some of that income out in terms of expenses. That will save you a lot of money. Again, when you fill your petrol tank or diesel tank or undertake maintenance or repair charges on your car again, you can expense that out to your business. Please check with your CA if your business would qualify for that. However, owning a business does allow you the option of doing it.

At least if you are a salaried employee, then this is something that you can’t claim. Now you might say what you have been saying about building businesses. I see the argument that it helps us save money also in terms of taxation. But don’t you think that it’s evil?

I would say no to that.

And there are two counterarguments to it. Number one, if you are building a business, then the first key thing about building a business is that it creates more jobs. For example, right now I am employing approximately 2 full-time employees, which is that I’m helping generate more jobs in the economy. And any nation would want to foster a more entrepreneurial culture. Now, if the government tries to push on a lot of taxes on businesses, what would happen is that many businesses might shift to Dubai.

A lot of people are already shifting to that. A lot of countries like Estonia, and Portugal are giving visas to entrepreneurs and they want people to come and work there. And this is becoming a big brain drain problem. So government also needs to ensure an effective mechanism for entrepreneurs to keep on engaging with the economy and start creating more and more jobs. So this is the first qualitative argument as to why businesses are not taxed as high as individuals.

Second, comes down to the risk-reward equations.

For example, when I decide to start a new business, then what happens is that I have

to put in so much capital to go to a certain scale. Only then does it start becoming profitable.

That is how the majority of the businesses function. So because entrepreneurs are taking more risk. So when things become successful for them, they are rewarded more. So this is a simple argument.

I understand that many of you might not agree with these counterarguments. Love to listen to that. But I am presenting to you one side of the equation. I’m not trying to paint jobs in a bad situation. I’m just trying to tell you or motivate you that go and try to start businesses because it can actually be a worthwhile exercise.

Why are the rich taxed less?

This gets me to the third point. And many a times you would have heard the news headlines that Jeff Bezos and Elon Musk. They do not pay any tax. They are paying close to 0% tax. But an average American is paying 35-40% tax. Is that not unfair? Yes or no. We need to understand the semantics behind that. So let me just very quickly in a very simple way, help you understand this concept. Right. So, let us try to understand this by using the examples of Tesla and Elon Musk. So let’s assume that in 2020, the value of the entire Tesla was $800 billion, $800 billion. Then in 2021, results were announced and the valuation of Tesla became bigger. It became $1 trillion worth of business. Now this $200 billion was the additional wealth that was generated. It is still logged into Tesla. It’s not as if Elon Musk has taken this 200 billion. No, that is not happening.

So this $200 billion of wealth is logged into Tesla, and therefore it is not taxed

from that perspective if you compare this with an income. Right. So income is a slightly different concept.

So on income. What happens is that, for example, if your income is one lakh rupees, then you have to pay a certain amount of tax on it because that is getting into your pocket. So the taxation structure on wealth is

very different from when income generation is happening. So very recently, Elon Musk decided that he would sell a certain bit of stack in Tesla, and whatever sale he made, he would have to pay tax on that, a much higher rate of tax compared to wealth building. So I hope this helps you understand that when you are reading news items like that, billionaires are paying no taxes at all.

That might not be the complete truth. Rich people, they build wealth, they invest in different businesses, and then they use that money to offset it.

This brings me to the fourth point as

How billionaires use loopholes

how billionaires can exploit certain loopholes to make more money.

So let me help you understand by using the example of real estate buying. So what happens is so let’s imagine that, for example, Jared Kushner, right?

Who is the son-in-law of Donald Trump and Donald Trump was the President of the US. So what he does is that he buys a bunch of properties in New York, so he will go and buy entire blocks of units of four really high-end properties in New York right now. How does he do it? He will buy this on debt. He will go to a bank, and take a debt. Why will he get a debt? Because he’s Jared Kushner. He has built business empires. Super rich guy. So banks also feel easy giving him money in terms of loans. Now on this debt, let’s assume that this debt is $1 billion. And on this $1 billion, he has to pay a yearly interest of let’s assume 60 million dollars.

Right. $60. Now that interest can be offset against the business revenues. So whatever money he’s making from this business, let’s say that he makes like $100 million.

But he’s paying a loan of $60 million. Then his profit becomes what his profit becomes $40 million. So he has to pay tax only on this amount. So this type of system is rigged because middle-class, lower-middle-class people and even rich people can’t get access to such large hoards of money and can’t exploit tax loopholes. So our goal in life should be to become so rich that banks literally give us cash for free. Because these days, literally cash is free. So read my other article You will understand that concept. That’s why you do high inflation. The cost of capital is extremely low. Whenever the cost of capital is very low, rich people can go and take bulk loans and literally do this exercise and keep on getting richer and richer. Now you might say, okay, we are speaking about American society.

What about India? Do people in India also do such stuff? Yes. Amitabh Bachchan has somewhat done it. Legal. Illegal? I don’t know. It is legal, probably.

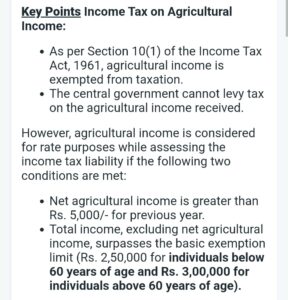

So in India, you have agricultural income.

Now, this is a very interesting paragraph. I will put it here. Please go and read it. Super interesting.

In India, the revenues from agricultural income are not taxed. For example, if you own 50 hactor of land and you are planting potatoes on it and you are making, let’s say, Rs50 of profit from it, then that income is not taxed.

Image Source: Google

Right. So a few years back,

Amitabh Bachchan legally saved a lot of tax by showing himself to be a farmer. Right? It is a funny thing, but it is a legitimate thing. Big farmers like Mr. Amitabh Bachchan or at an institutional level like ITC or Monsanto. These are huge companies that have

revenues in thousands and thousands of crores. They also save an insane amount of tax by exploiting this loophole of agricultural income. You tell me in the comment section. Is this fair?

Is this not fair? What did you like?

Which example did you like the best out of the five examples that I illustrated? This brings me to the final section of this article.

These are some of the key things that you can do in order to save tax.

What can you do?

Now, I’m not a CA, but there are some simple things that you can do. Claim all your deductions. Numerous videos on YouTube will talk about which section you need to explore and what you need to do to claim deductions. Please do that. Number two, if you have taken a house loan, you can offset that. Similarly, you can offset some of your taxes by taking an educational loan. Should you be taking a loan? Should you not be taking a loan? That is an entirely different discussion. But if you have taken a loan, at least take tax rebates on it. If you have donated to a nonprofit organization,

you can claim tax inputs on that. That can help you save money, even if you’re in a job. And finally, do try to think about how to start businesses because that is the most effective way to save taxes. And the more you earn, the more taxes potentially you can save, or you get more power to save more and more taxes. So I hope you enjoyed the article. I will see you the next time.

Let’s talk about first mover disadvantage.

Its a good article you have written with examples. Keep it up.