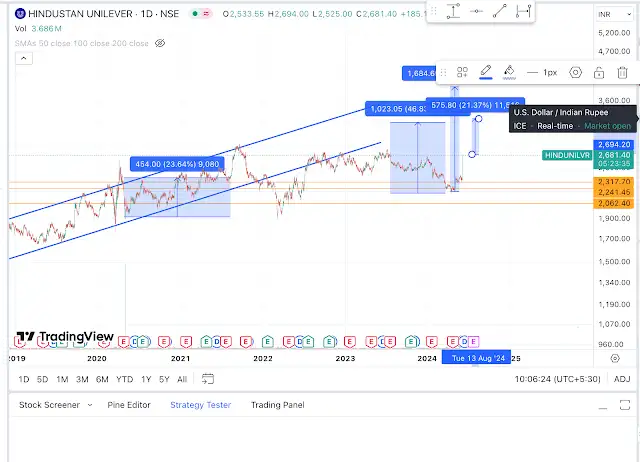

A few back I had explained the logic of holding stocks like HUL on your portfolio.

Most of my defence portfolio is made of HUL.

The Impact of Election Results on the Stock Market 2024

Why is Hindustan Unilever Limited (HUL) considered to be a risk-free stock?

Let me explain the logic:

[1] Your portfolio should be aggressive & defensive which means a balanced portfolio.

[2] In India, debt is NOT tax-effective anymore. Ex: when you do FDs, the capital gains you pay on slab (this could be 30%+ for rich folks)

[3] So if they have to look for safety in India, it is by default HUL type of stocks

[4] Right now people are looking for safety

[5] And, HUL was slightly undervalued

[6] The stock will likely run up, provided:

[7] There is more uncertainty in the market

[8] HUL is one of the best FMCG companies with very strong fundamentals.

[9] The stock is likely to give another 20%

[10] It is a blue-chip stock, it is the market leader. and It is a defensive stock.

Pick the quality stocks when they are available at a fair price. Buying Quality stocks at a premium valuation may not yield returns even after a few years.

Happy investing

This was one of your best recommendations khushal.🙌🏻